Jeremy Hunt warned not to spook markets with unfunded budget tax cuts – business live | Business

- Politics

- February 27, 2024

- No Comment

- 169

Introduction: Hunt warned pound would suffer if he misreads the markets

Good morning, and welcome to our rolling of business, the financial markets, and the world economy.

With just over week to go until the budget, Jeremy Hunt is being warned not to risk unfunded tax cuts that could cause ructions in the financial markets.

The chancellor is understandably keen to offer some pre-election sweeteners, in the hope of closing the gap with Labour. City economists, though, warn that there may not be as much fiscal firepower to play with as Hunt would like.

ING, the Dutch banking group, estimates that the money available for tax cuts – so-called “headroom” – now equals £18bn. That’s up from £13bn in November, but lower than estimated a few weeks ago, as the City has cut it expectations for Bank of England rate cuts.

This headroom is the amount of money the chancellor can spend, and still hit his fiscal rule – to have debt falling, as a share of GDP, in five years time.

£13bn could, potentially, allow the chancellor to cut income tax by 2p in the pound – as a 1p cut to the basic rate of income tax is slated to cost roughly £7bn/year. That wouldn’t leave very much left over, though.

As ING’s developed market economist, James Smith, puts it in a research note this week:

The situation is tight. And it’s possible our estimate of headroom is too optimistic.

What about cutting spending, though, to free up money for tax cuts? ING says such spending restraint looks “unrealistic”, given the government’s current plans already imply more painful austerity for departments.

Talk of tax cuts will revive visions of the 2022 mini-budget debacle, when Kwasi Kwarteng crashed the pound and the bond markets by announcing unfunded tax cuts, without any scrutiny from the independent Office for Budget Responsibility.

The situation is different this time – the OBR will give its verdict as soon as Hunt sits down next Wednesday after delivering the budget.

Smith says that funding tax cuts today with unrealised and potentially challenging spending cuts tomorrow may “raise a few eyebrows among investors”, but in reality this wouldn’t be a new approach.

Smith told Newsportu:

“The savings earmarked so far are already very challenging and further savings appear unrealistic.

Talk of tax cuts inevitably triggers memories of the 2022 mini budget crisis, where UK government borrowing costs rose precipitously following a package of unfunded measures designed to boost growth.”

He warns, though, that fresh tax cuts could still apply some upward pressure on yields – the measure of Britain’s borrowing costs.

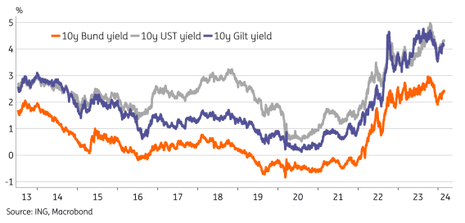

ING’s gauge of risk premium in the government bond market suggests investors are still keeping an eye on UK fiscal risk – with UK borrowing costs higher than Germany’s, but in line with the US.

Sizable cuts to income tax would add further impetus for the Bank of England to keep interest rates on hold a little longer, ING predicts, meaning more pain for borrowers and a delay to rate cuts.

ING reports that market conditions in the currency market are calm, which should please Hunt.

They say:

When it comes to FX markets, current market conditions could not be more different than those that prevailed at the height of the Liz Truss debacle.

But, they warn that if the chancellor was to “misread the mood of gilt investors and cause another upset”, sterling would take a hit.

ING add:

Short-term models suggest a 2% sell-off in sterling could happen quite easily were investors to again demand a risk premium of sterling asset markets.

The Institute for Fiscal Studies are pointing out this morning that UK taxes are heading to record-high levels, as a share of national income.

They warn that the public finances face an ‘unhappy outlook’, with debt high and rising, and barely on track to start falling in five year’s time.

In a warning shot to Hunt, they say:

Unless the Chancellor is willing to spell out where the cuts will fall, the temptation to scale back provisional spending plans further to ‘pay for’ new tax cuts should be avoided.

We’ll hear more from the IFS this morning, as they present their analysis of Hunt’s options ahead of the budget.

The agenda

-

8am GMT: Kantar’s latest UK supermarket sales and market share data

-

10am GMT: Institute for Fiscal Studies presents Spring Budget 2024: the Chancellor’s options

-

1.30pm GMT: US durable goods orders for January

-

1.40pm GMT: Bank of England deputy governor Dave Ramsden gives keynote address at Association for Financial Markets in Europe’s Bond Trading, Innovation and Evolution Forum

Key events

US recession fears as consumer confidence drops

Just in: US consumer confidence has taken a knock this month.

The Conference Board’s Consumer Confidence Index has fallen to February to 106.7, down from 110.9 in January, ending a three-month run of gains.

The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – fell to 147.2 from 154.9 in January.

The Expectations Index – based on consumers’ short-term outlook for income, business, and labor market conditions – slipped to 79.8 from 81.5 in January. An Expectations Index reading below 80 often signals recession ahead, the Conference Board says.

“The decline in consumer confidence in February interrupted a three-month rise, reflecting persistent uncertainty about the US economy,

Confidence deteriorated for consumers under the age of 35 and those 55 and over, whereas it improved slightly for those aged 35 to 54.”… pic.twitter.com/aY2aeMNiOC

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) February 27, 2024

Dana Peterson, chief economist at The Conference Board, says the drop in consumer confidence reflects “persistent uncertainty about the US economy,” adding:

“The drop in confidence was broad-based, affecting all income groups except households earning less than $15,000 and those earning more than $125,000.

Confidence deteriorated for consumers under the age of 35 and those 55 and over, whereas it improved slightly for those aged 35 to 54.”

Macy’s to shutter 150 stores amid focus on luxury

Over in the US, Macy’s has announced plans to close 150 “underproductive” stores – more than a fifth of its department store empire – over the next three years.

The business said it would shutter about 50 outlets by the end of 2024 after issuing a muted trading outlook for the year ahead.

As part of what it calls a “bold new chapter”, the retailer – which in January announced plans to cut 2,350 jobs, or 3.5% of its workforce – said it would concentrate more on luxury shopping.

As part of this focus, Macy’s plans to open 15 of its higher-end Bloomingdale’s stores, and 30 Blue Mercury cosmetics locations.

“A bold new chapter serves as a strong call to action,” Tony Spring, the new chief executive officer of Macy’s, said.

“It challenges the status quo to create a more modern Macy’s, Inc.”

DOW JONES DOWN 38.84 POINTS, OR 0.10 PERCENT, AT 39,030.39 AFTER MARKET OPEN

NASDAQ UP 36.96 POINTS, OR 0.23 PERCENT, AT 16,013.21 AFTER MARKET OPEN

S&P 500 UP 4.31 POINTS, OR 0.09 PERCENT, AT 5,073.84 AFTER MARKET OPEN

— First Squawk (@FirstSquawk) February 27, 2024

In the bond market, UK 10-year gilt yields have hit their highest level of the year today.

10-year bond yields are up four basis points (a small move) at 4.18%, the highest since the first week of December.

Bond yields rise when bond prices fall, and measures the cost of government borrowing.

At the end of last year, 10-year gilts were yielding 3.4%, having hit 4.5% in the panic after the mini-budget of autumn 2022.

But they have been rising in 2024, as the financial markets have trimmed their forecasts for interest rate cuts. And that has eaten into the amount of headroom the chancellor has to cut taxes and still point to debt falling within five years.

In the Sunday Times, Robert Colvile wrote that the numbers have been getting worse for the chancellor, as the Office for Budget Responsibility has updated its assessment of the economic outlook…..

Extinction Rebellion activisists target City insurance firms

Over in the City, protesters from Extinction Rebellion have occupied the offices of several major insurance firms.

Protests have taken place inside the “Walkie Talkie” building, which holds the offices of Tokio Marine, plus offices in Leadenhall Street, which Probitas operates from, Threadneedle Street, home of Talbot, and Creechurch Place, where Travelers operates.

XR say they want to “engage constructively” with insurance bosses, and encourage them to stop ensuring companies who are wrecking the climate.

🚨 LONDON: OCCUPATIONS ONGOING 🚨

“We are here to engage constructively with insurance bosses about their decision to insure the #fossilfuel crooks wrecking the climate. We’re staying until they come down and talk to us”

Inside Talbot part of the @AIGinsurance group.#ActNow pic.twitter.com/Nu3ykUNQ8W

— Extinction Rebellion UK 🌍 (@XRebellionUK) February 27, 2024

They also ‘occupied’ the offices of Zurich in the Shadwell area of London.

BREAKING: XRUK HAVE OCCUPIED A 5TH LOCATION@Zurich refused to meet our demands to stop enabling #fossilfuels, respect human rights & support a just transition at talks on Friday.

Today they’re facing consequences of their inaction as XR activists occupy their office!#ActNow pic.twitter.com/Mz13EoSDP1

— Extinction Rebellion UK 🌍 (@XRebellionUK) February 27, 2024

Over in Nigeria, the central bank has just announced a sharp increase in interest rates.

Nigeria’s central bank has decided to lift its benchmark interest rate by four percentage points, to 22.75% from 18.75%, a larger increase than expected.

The hike comes a couple of weeks after Nigeria’s naira dropped to a record low, after being devalued at the start of February.

Hedge Fund Founder: UK’s migration curbs pose risk to economy

A leading UK entrepreneur has warned that the government’s migration crackdown risks damaging UK higher education institutions, and could set back the country’s ambitions to be a leader in science and technology.

Ewan Kirk, founder of quantitative hedge fund Cantab Capital Partners, told Bloomberg that making the UK less attractive for overseas students will lead to a university funding shortfall and a reduced pool of talent for British employers.

Thiw would undermine the government’s efforts to make the UK the next Silicon Valley.

More here: Hedge Fund Founder Says UK Migration Curbs Pose Risk to Economy.

Late last year, the UK announced a package of measures designed to cut the number of migrant workers and their dependants entering the UK, including lifting the minimum salary requirement for a skilled worker visa.

Shein ‘considering London rather than New York IPO amid US scrutiny’

Julia Kollewe

The fast-fashion company Shein is reportedly considering a stock market flotation in London rather than New York because of potential problems with a listing in the US, its preferred location.

And Jeremy Hunt is said to be keen to persuade Shein to pick the City over Wall Street:

EXCLUSIVE: Jeremy Hunt, the chancellor, has met Shein chairman Donald Tang in a bid to persuade the Singapore-based online fashion giant to pursue one of London’s biggest-ever IPOs – a possibility I revealed in a previous story on @SkyNews in December. https://t.co/ubFGi8q2rz

— Mark Kleinman (@MarkKleinmanSky) February 27, 2024

Shein, which was founded in China but is based in Singapore, is in the early stages of exploring an initial public offering in London because it believes it is unlikely that the US Securities and Exchange Commission would approve its initial public offering (IPO), Bloomberg reported.

A UK listing would be a potential boost to the country’s standing as a global financial centre, after a number of companies snubbed the London stock exchange in favour of the Nasdaq in New York, despite the government’s efforts to persuade more firms to list there.

More here:

In the City, shares in Currys have jumped 3% as the battle to take control of the electricals goods retailer takes another twist.

Sky News reports that Elliott Advisors has improved its existing bid for Currys, slightly.

Elliott’s revised proposal valued Currys at between 65p and 70p-a-share, compared with an initial 62p-a-share bid worth £700m, they say. More here.

Currys rejected that earlier approach from Elliott earlier this month, while its share soared last week after Chinese e-commerce company JD.com said it was considering a bid.

The IFS’s pre-budget briefing ended with a discussion about the UK’s child benefit rules, under which payments are tapered if a parent earns over £50,000 per year, and cut off at £60,000.

This system, introduced by chancellor George Osborne in 2012, is criticised – as it doesn’t capture a household’s income (two parents earning £49,999 each would qualify for full payments, while one on £60,000 would lose the lot).

Paul Johnson says it’s not impossible that someone could still be entitled to universal credit despite earning £50,000 [due to recent changes in eligibility].

Carl Emmerson suggest that a “rational” system would say either that a) child benefit should be universal, or b) that it should be abolished, and the money used to make the child top-up payment in universal credit more generous.

The latter option could provide a means-tested system, which isn’t currently the case.

Incidentally, the Financial Times reports this morning that Jeremy Hunt is under growing Conservative pressure to reform child benefit and remove “one of the UK’s most notorious tax cliff edges”.

However, the chancellor’s allies said Budget measures on this issue were “unlikely at this stage” but had not been ruled out.

#Jeremy #Hunt #warned #spook #markets #unfunded #budget #tax #cuts #business #live #Business