Nvidia Stock Dips Despite Q2 Earnings Beat: Key Takeaways

- Economy

- August 29, 2024

- No Comment

- 106

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Nvidia reported its fiscal Q2 2025 earnings yesterday after the close of markets. The chip-designing giant reported better-than-expected earnings and its guidance was also ahead of what analysts were expecting. Still, the stock is down sharply in US pre-market price action today.

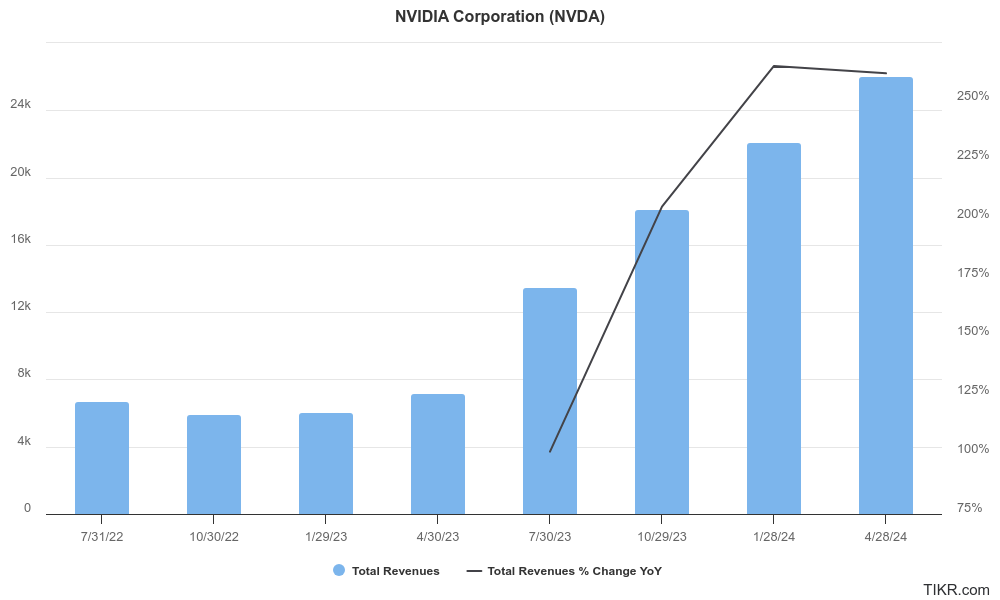

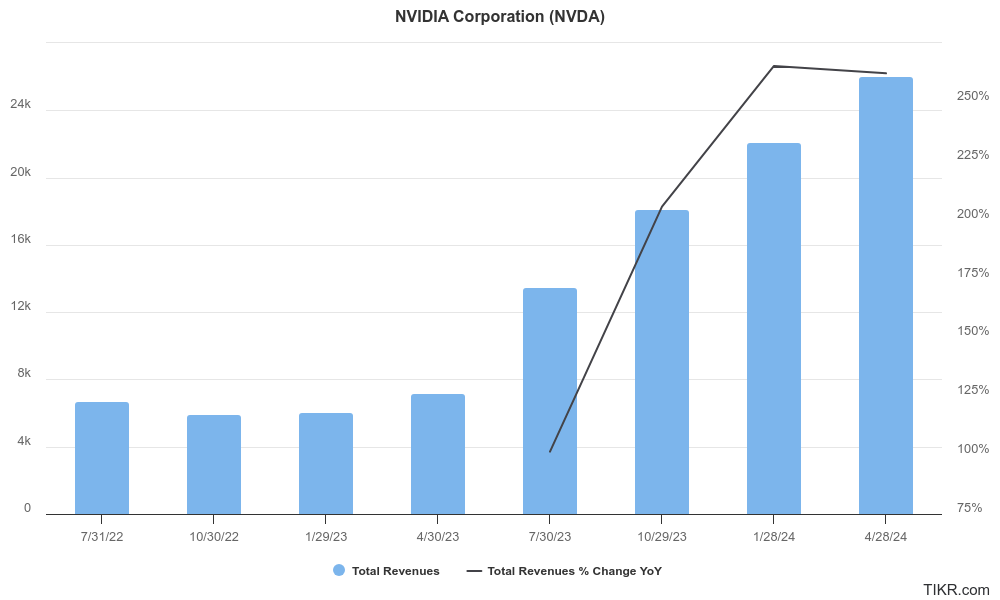

Nvidia’s revenues rose 122% YoY to $30.04 billion in the quarter which was not only well ahead of its guidance but also the $28.7 billion that analysts were expecting. The company’s adjusted per-share earnings of 68 cents also surpassed the 64 cents that markets expected.

Nvidia guided for revenues of $32.5 billion at the midpoint in the current quarter which was ahead of the $31.7 billion that analysts were expecting.

Sales of AI Chips Have Soared

Nvidia’s Data Center Business which sells the artificial intelligence (AI) chips reported revenues of $26.3 billion which were ahead of the $25.24 billion that analysts expected. The segment accounted for 88% of Nvidia’s total sales. While Gaming used to be a significant earnings driver for Nvidia, it now contributes less than 10% of its overall revenues. However, the dynamics have changed due to the AI euphoria which has helped spur the sales of Nvidia’s Data Center segment.

In his prepared remarks, CEO Jensen Huang said, “NVIDIA achieved record revenues as global data centers are in full throttle to modernize the entire computing stack with accelerated computing and generative AI.”

Thanks to the soaring sales of AI chips, Nvidia is generating healthy cash flows which enabled it to announce a $50 billion share buyback—the quantum of the current authorization is twice what it announced in 2023.

Nvidia Stock Falls Despite Q2 Earning Beat

Nvidia’s earnings were the most awaited event this week – if not the month. The stock had run up sharply after bottoming in early August amid the global sell-off and most Wall Street analysts buying the dip. However, despite beating the earnings, Nvidia wasn’t able to beat the high bar that markets have set for the company.

As Stephen Todd of Todd Market Forecast said, “Apparently the beat wasn’t as much as hoped for.” He however added, “But, it doesn’t look all that serious to us.”

JJ Kinahan, CEO of IG North America also echoed similar views. According to Kinahan, “They (Nvidia) beat but this was just one of those situations where expectations were so high. I don’t know that they could have had a good enough number for people to be happy.”

In an email to Newsportu, Investing.com senior analyst Thomas Monteiro said, “While the numbers indicate that the AI revolution remains alive and well, the smaller beat compared to the previous quarters adds to the multiple warning signs across the tech space earlier in this earnings season.”

EMarketer technology analyst Jacob Bourne said, “The company continues to benefit from a market paradox: Big Tech’s aggressive AI investment strategies drive massive demand for Nvidia’s chips, even as these same companies invest in developing their own silicon.”

Tech Companies Are Pouring Billions of Dollars into AI Infrastructure

Tech companies have outlined billions of dollars in capex to build their AI infrastructure and if anything, have been raised their guidance. A section of the market has however been apprehensive about the timeline of returns that tech majors will make on their AI capex.

Reacting to an analyst question on similar lines, Huang said during the earnings call, “The people who are investing in NVIDIA infrastructure are getting returns on it right away. It’s the best ROI infrastructure, computing infrastructure investment you can make today.”

Huang is quite optimistic about the GPU market and said that all data centers will move to GPUs. He emphasized, “And the reason for that is very clear: because we need to accelerate workloads so that we can continue to be sustainable, continue to drive down the cost of computing so that when we do more computing, we don’t experience computing inflation.”

Tech Companies Cutting Their AI Capex Is a Risk for Nvidia

Nvidia stock has been flying high amid the ever-growing AI capex. Josh Koren, founder of Musketeer Capital Partners believes that NVDA stock could slide if tech companies decide to cut back their AI capex. Koren said, “I wouldn’t be surprised to see it happen maybe within the next two or three quarters,” while adding that he expects Nvidia stock to fall by 20% when it happens.

Blackwell Chips Are on Track

Meanwhile, Nvidia tried to allay fears over its Blackwell chips getting delayed. CFO Colette Kress said, “In the fourth quarter, we expect to ship several billion dollars in Blackwell revenue.” She added, “When I said start production in Q4, I mean shipping out. I don’t mean starting to ship.” Huang was also quite upbeat on Blackwell chips and termed them a “complete game changer for the industry.”

Meanwhile, Nvidia shares are trading sharply lower today despite the stellar set of numbers. The pessimism has spread to other tech stocks also and chip companies are particularly looking vulnerable with names like Advanced Micro Devices and Broadcom down almost 4%.

#Nvidia #Stock #Dips #Earnings #Beat #Key #Takeaways