Here’s How Wall Street Reacted to Amazon’s Q1 Earnings

- Economy

- May 1, 2024

- No Comment

- 138

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Amazon (NYSE: AMZN) released its Q1 earnings yesterday after the close of markets. Here’s how Wall Street analysts reacted to Amazon’s Q1 earnings.

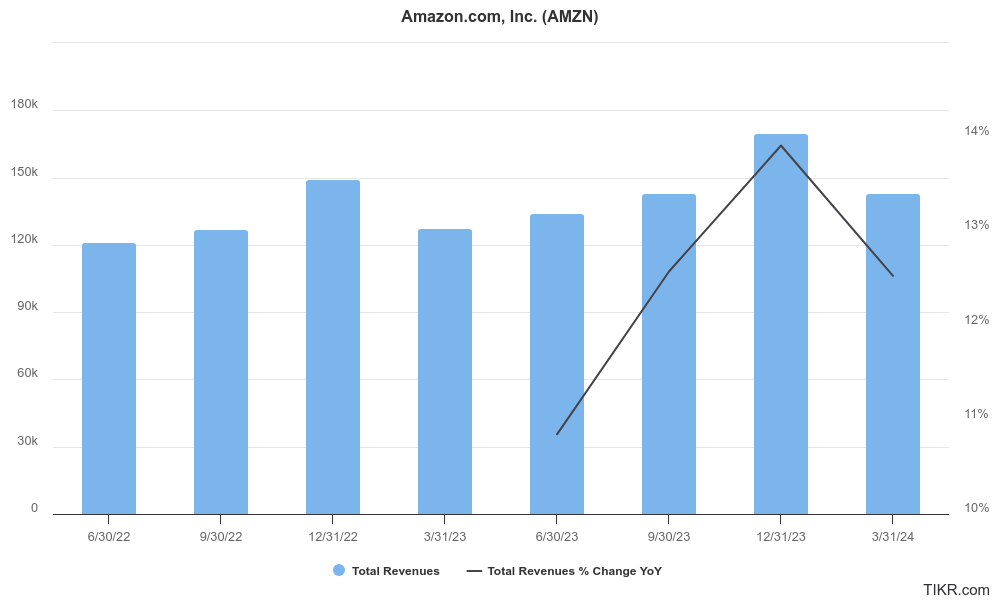

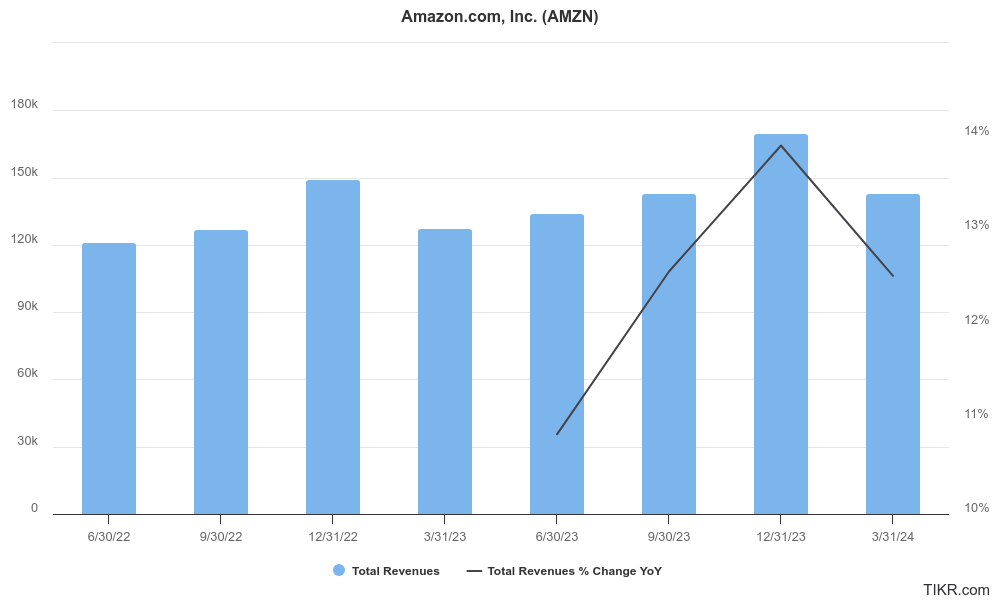

Amazon reported revenues of $143.3 billion in the quarter which was ahead of the $142.5 billion that analysts expected. The metric was also higher than the guidance that AMZN provided during the Q1 earnings call.

Looking at the different segments, the North America segment’s revenues rose 12% YoY to $86.3 billion while the International segment’s sales rose 10% to $31.9 billion. AWS (Amazon Web Services) revenues also rose 17% YoY to $25 billion. The segment saw a sharp deceleration in growth last year but growth rates have since rebounded and we‘re now seeing an increase in YoY growth.

Amazon’s Profits Soared in Q1

Amazon’s operating income more than tripled to $15.3 billion in the quarter. It was the first time that the ecommerce giant’s operating margins came in double digits and highlighted the aggressive cost cuts that it has implemented since late 2022.

The North America segment’s operating income rose to $5 billion as compared to $0.9 billion in the corresponding quarter last year. The International segment also posted an operating income of $0.9 billion versus an operating loss of $1.2 billion in Q1 2023.

AWS’s operating income also surged to $9.4 billion versus $5.1 billion in the corresponding quarter last year. AWS has historically been a cash cow for Amazon and during Q1 it accounted for 62% of its operating income in Q1 with a revenue share of only 17%.

Amazon’s net income rose from $3.2 billion to $10.4 billion in the quarter. Its EPS came in at $0.98 which was well ahead of the $0.83 that analysts expected.

Amazon guided for revenues between $144 billion to $149 billion in Q2 which implies a growth between 7%-11%. The guidance fell slightly short of the 12% YoY growth that analysts were expecting.

Andy Jassy on AMZN’s Earnings

In his prepared remarks, AMZN CEO Andy Jassy said, “The combination of companies renewing their infrastructure modernization efforts and the appeal of AWS’s AI capabilities is reaccelerating AWS’s growth rate (now at a $100 billion annual revenue run rate).”

He added, “our Stores business continues to expand selection, provide everyday low prices, and accelerate delivery speed (setting another record on speed for Prime customers in Q1) while lowering our cost to serve; and, our Advertising efforts continue to benefit from the growth of our Stores and Prime Video businesses.”

Jassy was also upbeat on Amazon’s generative AI business and said, “We’ve accumulated a multibillion-dollar revenue run rate already.”

How Analysts Reacted to Amazon’s Q1 Earnings

Wall Street analysts reacted positively to Amazon’s Q1 earnings. JPMorgan analyst Doug Anmuth who has a $240 target price on AMZN said, “AMZN’s greater capital intensity — which is coming mostly in AWS — is driven by increased demand for cloud services and GenAI. We believe this is positive as AMZN has a very clear path to monetization of infrastructure investments through AWS, & has a track record of favorable return.”

Bank of America also reiterated its buy rating on the stock and was particularly impressed by management’s stance on margins. Despite ongoing investments, Amazon expects its margins to expand. Alphabet, which became a $2 trillion company after its Q1 earnings release also provided a similar commentary on its margins.

Meanwhile, despite stellar earnings, Amazon shares are up only marginally likely because of the light guidance. Meanwhile, Jim Cramer is not too perturbed by Amazon’s guidance and instead called it an “extraordinary quarter.”

“I don’t think it will matter but the Amazon quarter was spectacular and the guide was almost boilerplate given the gathering momentum in eps, free cash flow, gross margins and orders for AWS,” tweeted Cramer.

#Heres #Wall #Street #Reacted #Amazons #Earnings